Last week, the Federal Trade Commission (FTC) filed a lawsuit in federal court against JustAnswer LLC and its CEO, arising from the company’s subscription program. According to the complaint, JustAnswer operates an online platform that engages “experts” where consumers can ask questions through online chats or phone calls about various subject areas.

The complaint alleges JustAnswer advertised a nominal fee for consumers to join the platform and receive an answer to their question (often $1 or $5). However, the FTC alleged that after the customer agreed to the nominal charge, JustAnswer simultaneously enrolled customers in an autorenewing subscription and charged them a much larger monthly fee ($28–$125) and continued to automatically charge consumers every month until the consumer canceled the subscription.

FTC Challenges Low-Fee Subscription Advertising

According to the FTC, the company violated Section 5 of the FTC Act by misrepresenting that consumers could enroll and receive JustAnswer’s services for only a low one-time fee. The agency also alleged Restore Online Shoppers’ Confidence Act (ROSCA) violations for failing to clearly and conspicuously disclose the material terms of the subscription service and failing to obtain express informed consent before charging consumers.

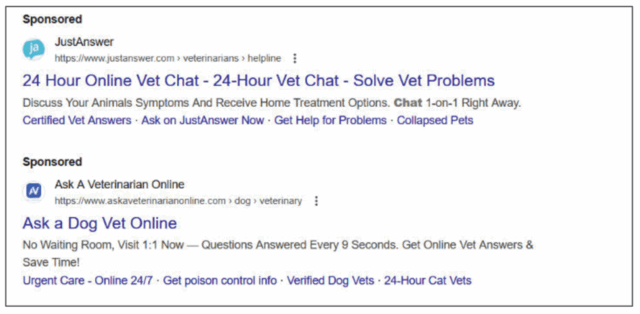

At the outset, the FTC alleged that the company’s search ads failed to disclose its fee structure or terms of the monthly subscription, including in the following ads:

Interestingly, the FTC took this position despite the ads containing no price representations, possibly marking a turning point as the agency argues other cases in which businesses must disclose the existence of negative option and subscription pricing in every search engine ad, even if no pricing claims are made.

Disclosure Failures Under ROSCA Scrutiny

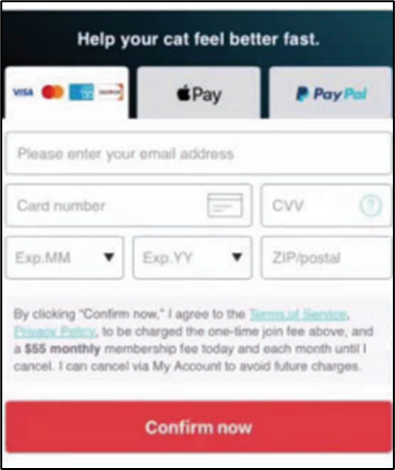

In addition, the FTC determined the below disclosure to be insufficient, even though the subscription price and frequency were bolded. The agency cited several reasons for its conclusion, including that:

- The material terms were still difficult to see in comparison with the much larger text on the payment form

- Consumers were unlikely to notice the small print text

- The consumers who did notice were unlikely to understand the disclosure language because it contradicted the representation from JustAnswer representatives that they could join for less

Moreover, according to the FTC, while the hyperlinked Terms of Service contained information about JustAnswer’s subscription pricing, consumers were not required to click on the link to complete their enrollment. If a consumer did click on the terms, the FTC noted they were dense and lengthy, and consumers would have needed to scroll halfway through the terms to locate the material subscription terms.

The FTC next alleged that because consumers were not presented with clear and conspicuous terms, JustAnswer failed to obtain express informed consent before charging the consumer. This is consistent with other regulators’ positions, including California’s Automatic Renewal Taskforce (CART). According to these regulators, a consumer cannot provide “informed” consent if the website does not inform them of all material terms of the transaction.

The agency also noted that while some iterations of JustAnswer’s payment form included a checkbox, the checkbox was pre-checked and thus did not require consumers to click on the checkbox to complete the customer’s enrollment. The FTC also took issue with the checkbox disclosure’s omission of any language regarding the price consumers would pay for the subscription.

FTC Escalates Enforcement Against Autorenewals

The FTC has continued to bring enforcement actions under ROSCA, with prominent examples including cases against Uber, joined by multiple state attorneys general. The agency also recently settled a case with Chegg for $7.5 million, in which the FTC alleged that the company made it difficult for consumers to cancel their recurring subscriptions.

For more insights into advertising law, bookmark our All About Advertising Law blog and subscribe to our monthly newsletter. To learn more about Venable’s Advertising Law services, click here or contact one of the authors. And listen to the Ad Law Tool Kit Show—a podcast from Venable.